This form of import is defined to work with transactions from the system DK, without needing many changes. Before the transactions are imported, make sure every account key is defined in Regla.

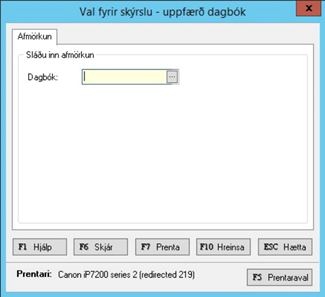

To export transactions from DK go to Fjárhagur/Skýrslur/Uppfærðar and click skjár.

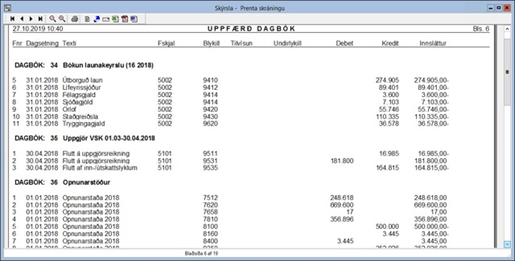

Then you will get an overview of all updated accounting books in DK:

At the top of the window you can export the data into an Excel file. In Excel you can delete unnecessary columns and rows. Remove all rows with headings (the top row with the column names can stay). Remove the first and the last columns (Færslunúmer/Fnr and innsláttur). It’s also correct to remove all lines labeled Opnunarstaða and uppgjör.

Important:

Before importing to Regla, inspect the account keys in the Excel file. Most keys need to be changed to a corresponding account key that is registered in Regla.

Field labels:

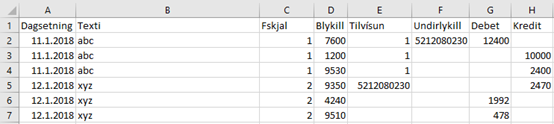

1.Booking date

2.Transaction text

3.Document number

4.Accounting key

5.Reference

6.Subkey (SSN)

7.Debit amount

8.Credit amount

Example in Excel:

CSV example:

Dagsetning;Texti;Fskjal;Blykill;Tilvísun;Undirlykill;Debet;Kredit

11.1.2018;abc;1;7600;1;5212080230;12400;

11.1.2018;abc;1;1200;1;;;10000

11.1.2018;abc;1;9530;1;;;2400

12.1.2018;xyz;2;9350;5212080230;;;2470

12.1.2018;xyz;2;4240;;;1992;

12.1.2018;xyz;2;9510;;;478;

Description:

The column subkey is for accounting keys that require a ssn. The ssn must be registered to a customer in Regla.

Document number can be either number or text. The document number is used to link together the amounts in the transactions. Debit and Credit amounts within the document number must add up to zero. VAT transactions’ keys must be registered as a VAT key.

Example, for document number 1 above: The transaction in line 2 (key 7600) has its VAT amount in line 4 (key 9530). For the system to know these lines are connected, the key 9530 needs to be registered as a VAT key to the key 7600. The amount on both of the lines also has to match given the VAT percentage given on the VAT key.

Error checking when importing:

If errors found when Error check/Save is clicked, transactions with errors will be shown and erroneous fields will be marked in red.

If some records are found erroneous, no transactions will be imported to the system. And the Excel/Csv files need to be corrected and then imported again. If you hover the mouse on the erroneous field, you will see explanations for the errors. If more than one field in the line are with errors, only the explanation for the first error will be shown.