If not already done, request has to be sent to treasury tax collectors email tbrlaunagr@fjs.is for monthly text file for import of other taxes.

Information in the mail should include:

•Companies ssn number (kennitala)

•Name of company

•Name of mail contact/receiver person

•Contact/receiver persons email

•Name of the salary system (Regla)

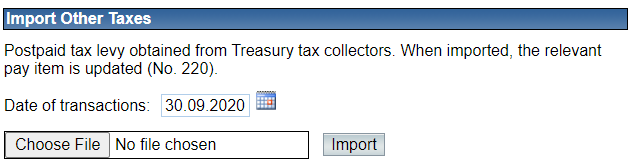

Treasury tax collectors send text files monthly with the imposition of public taxes which are deducted from employees. This is a text file with entry lines and batch entry which is at the bottom of the text file. The file is imported by selecting the file, choosing a date for the entries to be registered to and finally clicking on „Import“.

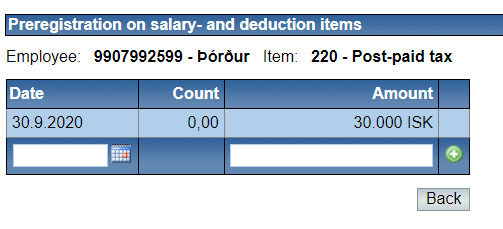

Deduction items for the post-paid tax will be registered to the date that was selected for the import, the item can be found under the 'salary and deduction items' table under each employee.

Of course this tax information can also be registered direct in Regla as other deduction items although we highly recommend receiving the text file.

Once the salary has been calculated, the taxes are sent to Treasury tax collectors. See Various processing > Taxes other than witholding

When this documentation is done in summer 2019 a claim request for the payments are not done by the tax collectors but they are working on it.