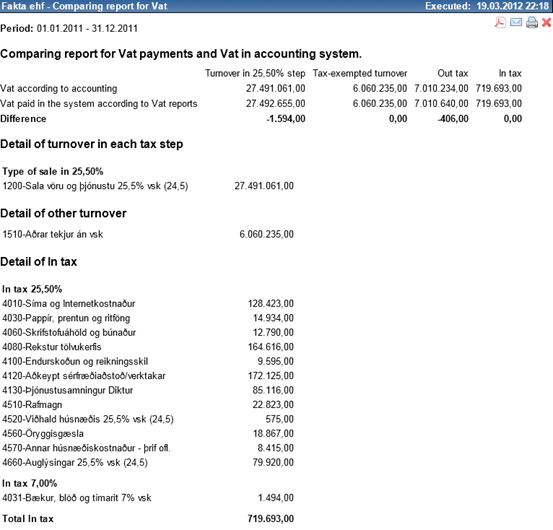

Here you could see the comparison between Vat calculated by the system and Vat actually paid to tax authorities.

If any operation in the system affect the VAT has been done after Vat has been processed and confirmed, the system will require VAT correction process.

In the sample report shown below, you can find some difference in the Out tax field. If the report indicates some differences, the Correction report for Vat should be used.